Monash SoDa Laboratories researchers Professor Paul Raschky, Associate Professor Simon Angus and Research Fellow David Kreitmeir write about their latest study on local news outlets.

The state of local journalism, especially in Australia’s regional and rural areas, is experiencing significant shifts. A recent study called The Socio-economic Determinants of Public Interest Journalism in Australia, conducted by Monash Soda Laboratories in collaboration with the Public Interest Journalism Initiative, explores the socio-economic determinants that influence the presence of local print and digital news outlets across Australia.

The research was done at the Local Government Area (LGA) level in Australia utilizing a comprehensive dataset covering 540 LGAs across all Australian states and territories. The research team combined three datasets: A dataset on the availability of local print and digital news outlets, assembled by PIJI, local socio-economic variables from the 2021 Census of Population and Housing by the Australian Bureau of Statistics (ABS), including demographic and labor market characteristics, and LGA-level data on industry composition, unemployment rates, and remoteness.

For the analysis, LGAs were categorized based on population size for. Those with less than 10,000 residents are classified as either having or lacking news coverage. LGAs with populations of 10,000 or more are grouped into either monopolistic or competitive news outlet markets, based on the ownership structure of the news publishers present.

News Publisher Outlet Coverage in smaller LGAs

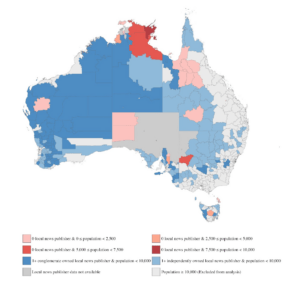

By mapping the various forms of local news markets across Australia, we begin our descriptive analysis of the data for disparities in the existence of local news publisher outlets in LGAs with populations of 10,000. Figure 1 depicts all of Australia’s LGAs. The light grey areas are LGAs with populations more than 10,000, and they are included in the sub-sample used in the following section. The 242 LGAs with fewer than 10,000 persons are represented by LGAs in light and dark blue and red.

While the majority of LGAs have access to at least one news channel (blue), coverage is not universal; 29 LGAs have no coverage (red shadings). The latter are generally located in distant places and have a low population density. For the former, 91 LGAs are entirely served by news media “conglomerates” (dark blue), which are defined as news media businesses with print and/or digital news publishers in more than one state. Light blue areas signify local government districts with at least one “independent” news outlet.

Figure 1. News publisher outlet coverage in smaller LGAs

News Publisher Outlet Coverage in larger LGAs

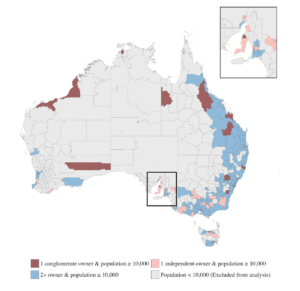

Turning to the sub-sample of 298 larger LGAs with a population of 10,000 or more people where the report analysed on market structure rather than coverage versus no coverage. In particular, the authors distinguish between LGAs with a “monopolistic” local news publisher market (just one news outlet or several news publishers owned by a single conglomerate) and LGAs with a “competitive” market structure (2 or more local news publisher outlets owned by independent owners).

Figure 2 depicts a reasonably homogenous geographic distribution of “monopolistic” (red shades) and “competitive” (blue) news outlet marketplaces in populous LGAs with a population of at least 10,000 people. Furthermore, we see that a “conglomerate” owner controls around 36% (20/55) of the “monopolistic” news outlet markets (dark red). Furthermore, Figure 2 demonstrates that “monopolistic” market systems are not limited to regional or isolated places, but are also prevalent in metropolitan centres such as Adelaide (zoomed in display in upper right corner).

Figure 2. News publisher outlet coverage in larger LGAs

Findings

The report has a number of key findings:

The Vital Role of Local Markets: One of the key takeaways is that the size of the local market—both in terms of readership and consumer base—plays a crucial role in the viability of local news publishers. If the numbers don’t add up, local publishers struggle to survive, given the reduced attractiveness for advertisers. In smaller LGAs, those with under 10,000 people, the total population consistently predicts the presence of local news publishers. Higher proportions of First Nations people and a more substantial number of businesses in sectors like mining, healthcare, and social assistance correlate positively with news availability.

Larger Local Businesses and News Markets: Interestingly, the study suggests a link between the presence of large companies, particularly in the mining and manufacturing sectors, and the robustness of local news markets. This correlation points towards the economic foundations that support a diverse media landscape.

A Spotlight on Local Government Areas (LGAs): Of the 540 LGAs examined, 29, or 5.4%, have no local print or digital news publishers. This lack is more pronounced in remote and less populated regions, particularly in the Northern Territory and Queensland. In contrast, larger populations generally bolster the existence and sustainability of local news outlets, with the number of businesses in a sector being a stronger indicator of news availability than the number of sector employees.

For Larger LGAs: In areas with more than 10,000 residents, the trend is similar. More manufacturing, professional, scientific, and technical businesses correlate with a more competitive local news market, indicating that a local economy with larger companies may encourage a more varied range of local news publishers.

Takeaways

The report presents comparative analysis to identify socio-economic differences in LGAs with different levels of news media coverage and market competition. It is important to acknowledge the limitations of this data and the lack of exogenous variation in the key variables, which precludes making causal claims about the impact of individual socio-economic factors on the availability of local news publishers or the competitiveness of local news markets. This preliminary analysis reveals limits and suggests paths for future empirical research in this topic.

Two fundamental data restrictions must be addressed: First, a next step should be the collection of time-series data to capture the dynamics underlying local news markets. Creating panel data on local news publishers, including their entry and exit timing, would be a huge improvement. Further research on the local news market structure, publisher business models, and content would enhance empirical analysis. This would help examine the mechanisms behind local news publishers’ market entry and leave, and their impact on Australian society and politics. Second, the study excluded radio and television broadcast news due to a lack of data on their news output. Obtaining transcript data from the entire industry would enable future studies to include these outlets.

Once these data criteria are completed, subsequent study could explore numerous areas:

- Investigating the impact of local news outlet availability on voter information and behaviour.

- Investigating the impact of public interest journalism on democratic engagement and vote outcomes.

- Examining how local news outlet circulation affects election outcomes.

- Assessing readiness to pay for tax deductions for charitable contributions to local news outlet apprenticeships.

- Examining the impact of news media content and bias on contagion.

Read The Socio-economic Determinants of Public Interest Journalism in Australia report here.